Content

- Need to buy gold? Save up, prices to drop by mid-2023

- Billionaire Charles Schwab Has Lost Nearly $3 Billion of Personal Wealth Since Silicon Valley Bank Collapse

- Love of decorating balconies turns profitable for expat

- Sending you timely financial stories that you can bank on.

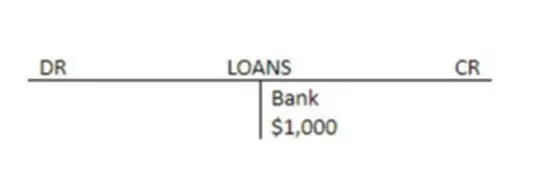

- Interest Payments

- Become a Real Estate Investor.

Instead of looking for multiple types of investments or businesses, you can think of multiple ways to create income within your current investments or business. The hidden danger of pursuing multiple streams of income is that you’ll create distractions. There are other ways to invest in real estate without actually buying a physical location. REITs, or real estate investment trusts, are kind of like mutual funds, but for real estate.

At least not with the https://www.bookstime.com/ platforms that I’m about to show you. Invested Media LLC may have financial relationships with the companies mentioned or seen on this site. We are not responsible for any actions taken by users. Creating digital products, ebooks or guides can be time-intensive at the beginning.

Need to buy gold? Save up, prices to drop by mid-2023

If you don’t want the work of being a landlord but want diversification, look around to see if REITs might be a better option for you. And while the money doesn’t go up quickly, it generally doesn’t go down quickly either. Interest earning vehicles tend to be much less volatile than stock investments, so they have role to play in your portfolio, depending on your risk profile. So the money that you make from the sale of your stocks, isn’t interest paid it’s the value that the company has built up, and you are now selling at a gain. In investing, the best way to keep yourself safe is to diversify.

Buying such items and selling them, priced appropriately, will generate a capital gain. The logic experts explain is simple when it comes to earning a royalty income, there are no limits on what you offer as long as there is a demand for it and value in it. If you are an academic, writing journal articles will earn you monthly royalty fees based on readership and impact of your research. If you are a musical artist or a photographer, your work can be monetised similarly.

Billionaire Charles Schwab Has Lost Nearly $3 Billion of Personal Wealth Since Silicon Valley Bank Collapse

multiple streams of income Gain is the appreciation of an investment and it is considered to be realized when the investment is sold. Capital gain can be subjected to capital gain tax in certain countries, where taxation usually differs between short-term or long-term . Passive income – Income earn at intervals due to a decision or task performed previously. Passive income does not usually require you to exchange time for money.

- Fortunately, a good friend helped me hone in on the idea for my course a few years ago.

- We consider capital gains as a passive income stream even though it’s so lumpy because you can turn a holding into a stream by simply selling shares from time to time.

- The amount of interest income you can earn from a government bond is highly dependent on the defaulting risk of the borrower.

- Rich people often still take out home loans anyway even though they could pay cash.

- When striving to be a self-made millionaire, having a full-time job is a plus, so is investing in stocks and property.

One photo can sell to multiple clients, so your photos can become passive sources of income. According to researchers, that’s the average amount people earn with side hustles. That’s enough to pay off a chunk of your student loans or credit card debt, build an emergency fund, or pay for that vacation you’ve been dreaming of for years.

Love of decorating balconies turns profitable for expat

Buying and selling assets can provide you with an income known as capital gains. For example, if you buy stocks and shares worth $100 and then sell them on for $120, the capital gain is $20. Without an income stream, your business is at risk of failure. Many small businesses have a single income stream, such as an electrician or plumber. Having multiple streams of income is a good way of safeguarding your business against a downturn in one particular stream.

You can sign up with Curb-It to find removal jobs in your area. Inviting friends and family members to sign up for a service or product you use can be an easy way to earn a referral bonus. For example, every friend you invite to Acorns who signs up and makes their first investment can mean a $5 referral bonus that gets invested in your Acorns Invest portfolio. There’s no limit to how many friends you can invite, and best of all, your friends also get a $5 bonus investment, too.

Sending you timely financial stories that you can bank on.

You also need a car that’s in good shape and reasonably new. Check out this post to learn more about how to drive for Uber or sign up to drive with Uber. If you love to write, it’s not that hard to start freelancing on the side from home. With websites like Contently, Upwork.com, Freelancer.com, and LinkedIn ProFinder, you can create an online profile and bid on new jobs as they are posted.

What are the 5 habits of millionaires?

- They're avid readers.

- They understand delayed gratification.

- They stay away from debt.

- They budget.

- They give.

- Ready to Become a Millionaire?