Contents:

On the transaction form, select I have authorization and would like to process this transaction. If you don’t have to save the bank info, you have 10 minutes to process the payment. Barbara is currently a financial writer working with successful B2B businesses, including SaaS companies. She is a former CFO for fast-growing tech companies and has Deloitte audit experience.

Shoppers and merchants alike love ACH payments, which is why they’ve consistently increased in popularity over the last decade. Nowadays, there are more than 25 billion ACH payments each year. A bank-to-bank transfer of funds might seem old-fashioned, but this payment method is efficient, secure, and affordable. If you’re being paid by a company as a vendor through a platform such as Gusto or Bill.com, it might cost you nothing to accept an ACH payment. Companies typically pay a subscription fee to use their payment processor, which covers ACH transaction fees. Or maybe you have a contract with a customer and you will be billing that contract in phases.

That’s because, with wire transfers and paper checks, routing numbers may be shared. Fraudsters enjoy devising wire transfer scams that include phishing and altering paper check amounts. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business.

We take care of all payment-related security for you, so you can focus on your growing business. We maintain Level 1 PCI DSS compliance, meaning we use industry-standard security measures. That includes multi-factor authentication and tokenization to protect sensitive information and stop fraudulent transactions in their tracks. Banks can’t offer ACH transfers to any international accounts.

On-time Support

Select the Check or ACH payment method as you create a one-time or recurring sales receipt or as you receive a payment. QuickBooks Desktop only offers the sales receipts method for recurring ACH payments. QBDT requires manually receiving ACH payments for invoices not issued as recurring sales receipts. Ultimately, the payment methods your business accepts will depend on the products you sell and the preferences of your customers. If you sell a subscription-based product and appreciate affordable low fees, ACH payments could be right for you.

Accept Credit Card Payments Online QuickBooks – quickbooks.intuit.com

Accept Credit Card Payments Online QuickBooks.

Posted: Thu, 30 Oct 2014 19:01:51 GMT [source]

ACH Direct Debit is available for U.S. transactions for an additional processing fee that varies according to your pricing agreement. Square is a popular online and POS payment system for small businesses. It’s free to use, and you pay 1% per ACH transaction (minimum $1). Dozens of payment platforms facilitate ACH payments for payers and payees.

Cost of Accepting ACH Payments

You’ll need a third-party bill pay and payables automation system to pay your supplier invoices using regular ACH payments. Choose the template, then in the Action column ▼ dropdown menu select Use to use the template as a starting point for a new transaction. The receipt will automatically process the ACH payment on the next scheduled charge date. View details for a recurring charge and on the Payment Details tab, click the Delete button. The record disappears and no future payments are processed. The following steps cover what a recurring payment is and how to process ACH payments in QuickBooks Online and QuickBooks Desktop.

- You can either read a script to your customer, use an Intuit Merchant Services eCheck, or an ACH bank transfer authorization form.

- Global mass batch payments or smaller bill payments with each vendor’s preferred currency and payment method .

- You can expect to pay around a 1% fee or less with most platforms .

- The sales receipt will process the ACH payment on its next scheduled charge date.

- They have the lowest processing fees of all payment methods.

ACH transactions include electronic payments of vendor invoices. After customer invoicing by vendors, supplier invoices may be emailed or uploaded to an accounts payable/vendor payments system. View, modify, and personalize reports for recurring transactions by customer using Manage Recurring Payments.

San Ramon based Accounting & Controllership Company

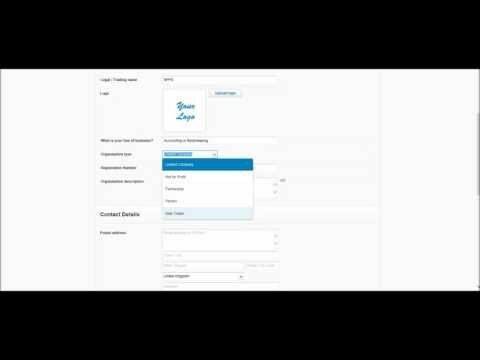

If you use QuickBooks, apply for QuickBooks Payments through the software. Here is how to set up ACH payments in a step-by-step guide. This guide includes entering more account information about your business. It will also go over your merchant account number to use for the system. For recurring ACH transactions in QuickBooks, you’ll require QuickBooks Payments. Your clients will also need to sign a connected QuickBooks ACH authorization form.

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication.

To examine details and/or alter existing recurring payments, click the customer’s name. In the Manage Recurring Payments feature, stop recurring ACH payments using the edit link in view/edit recurring transactions. You can change the End Date to stop the recurring ACH.

- Same Day ACH is becoming more common but currently comes with higher fees for the payer or payee.

- Barbara is currently a financial writer working with successful B2B businesses, including SaaS companies.

- If you click Save and send when you’re done to email a copy to the customer, you can see a preview first.

- With the help of this software, you can import, export, as well as erase lists and transactions from the Company files.

You’ll notice there is a drop-down arrow next to the Edit link on the Recurring Transactions screen. You can click on this arrow to choose to use, duplicate, pause, skip next date or delete recurring transactions. You can also click the Edit link to make a change to the recurring transaction template if you want to make a permanent change to the template. A step-by-step guide on how to create and schedule QuickBooks recurring invoices. ACH payments can be one-time payments or recurring transactions.

The Drawbacks of ACH Payments

Finally, if you want the https://bookkeeping-reviews.com/ to be created every two months, every quarter, every six months, etc., enter a number into the last box. So, if you want an invoice to be created quarterly on the second Monday of the month, you would set the fields as shown in the above screenshot. Intuit Merchant Services with QuickBooks Payments doesn’t currently allow users receive Same-day ACH automatically. Nacha provides a schedule for requesting ACH payments through the Automated Clearing House. The Nacha schedule shows time windows for processing Same Day ACH payments and funds availability times. Nacha includes three separate time windows for Same Day ACH transaction processing.

Although there are drawbacks, they’re fairly minimal and it’s unlikely that they’ll impact your business. When you have multiple checks that you’re going to combine into one deposit, you should have the payment deposited to the Undeposited Funds account. This is an account that holds any payments that have come in but not yet been physically deposited in the bank .

In 2021, there were nearly 14 billion consumer bill how to prepare a trial balance in 5 steps using ACH transfers, amounting to $8.89 billion dollars. Still, if you don’t have hands-on experience with ACH transfers, you might be hesitant to accept them as a form of payment for your business. In this article, we’ll get detailed about what ACH payments really are and how they work so you can make the best decision for you. Banks have to be part of the Automated Clearing House network to accept and send ACH payments.

QuickBooks explains how to process an ACH bank transfer from a customer. Vendors can accept customer payments for either a one-time invoice, a one-time sales receipt, or a recurring sales receipt. Using ACH, debit card, credit card, or PayPal as payment options, use this guide to apply for and set up a QuickBooks Payments account.

Once set up, your payment system automates the entire process. You and your customer don’t need to spend any time or effort on it. Plus, you won’t have to chase down any late payments. Of course, you can also check the payment status of the invoices you’ve sent in the browser-based version of QuickBooks Online on your desktop or laptop.

However, they’re generally best for automatic bill payments. ACH payments are similar to the use of a check since it transfers funds from one bank account to another. For this reason, ACH payments are commonly used when paying for utilities or mortgages. Share profits from processing fees and earn money while providing top-notch payment services to your customers. ACH payments are electronic transfers from one bank account to another, almost exclusively within the U.S.