Articles

I really don’t pay credit card attention while the We pay the equilibrium, but I actually do provides a running spreadsheet away from my personal financial membership in which I’ve determined the eye and you can rates of the offset which i inform as the account balance transform. As well as, Japanese banking institutions are protective of the yard, and cash purchases is just one treatment for restrict Alipay, UnionPay, Apple Pay etc. of expanding, internet explorer he has a reward to cultivate technical to possess addressing and you will tracking of cash. We do know for sure you to definitely shopping and general repayments in the bucks are reducing easily. We realize the con rates from card payments is significantly less than the loss rates of dollars.

It is more challenging to help you successfully deal dollars than the taking money on line. Whenever taking cash, there is a likelihood of bringing trapped to your a monitoring cam. Even though you don’t possess CCTV footage, if you can offer a description of the individual which robbed your, it can be helpful in distinguishing them. In the cases of credit ripoff, someone usually do not know in which they missing its cards info 1st, so it is hard to regulate how the brand new fraud taken place. So it not enough information adds to the challenge from solving the new instance. There are numerous message boards where people boast in the these types of bad issues, and tend to hold off days just before paying the newest taken currency.

Financial Load away from A lot of time-identity Care: The new Terrible Situation

Later Boomers also provide your pet dog regarding the battle, that have all the way down wages, along with high jobless on the later 1980s and you can early 1990s. Among are Millennials, having large house rates and you may probably rockier work, however, by specific tips increased throwaway earnings. Search of FIS suggests Gen Z are the most effective savers, during the 23%, accompanied by Gen Y/Millennials at the 20% of income. Throwaway money certainly more youthful generations was also high, presumably as they’ve taken up less big costs such as a mortgage otherwise auto loan.

Connect with ABC News

Influencer Emily Webb, twenty five, who purchased the woman earliest family this season, a condo inside Queensland you to costs the woman over $one million, and doesn’t believe Boomers recognize how difficult the brand new housing market try. The fresh 27-year-dated business worker said indeed there’s without doubt in her own mind you to Gen Zers is actually facing typing a much more difficult assets field. Gen Zers and you may Millennials aged ranging from 18 and you can 39 overwhelmingly decided one past household costs was less expensive. Australians has consented one Boomers had they easier when purchasing its very first home nevertheless more youthful generations aren’t off of the hook up entirely regarding love coffee and pricey avocado allegations. All the details available with Offers.com.au try general in general and does not make up your own expectations, financial situation, otherwise needs. We recommend seeking to separate economic information before you make one economic behavior.

Heredity fees

«The new Set-aside Financial out of Australia’s Individual Percentage Questionnaire exhibited on the earlier 36 months the new part of Australians spending with cash have halved away from over 27 % away from full payments to simply 13 per cent.» I concur the fresh notes be reason for concern but We did not panic since the my cellular phone instantaneously pings me whenever an exchange takes place. If someone else choose to go in order to urban area for the paywave I believe my personal financial do reimburse me. I believe which have mostly cash in it might incentivise individuals deal it more tbh because there isn’t any listing of their thieves. By purchasing items or functions, you’re also entering into an agreement for the merchant.

- We won’t getting providing you with investigation for the either even when when the you choose to troll the brand new roadways they’s you are able to plus likely that you may possibly gather it yourself.

- Remaining bucks up to they very first economic exposure management, so there are lots of risk minimization tips for staying you to cash secure than simply making they sleeping up to randomly.

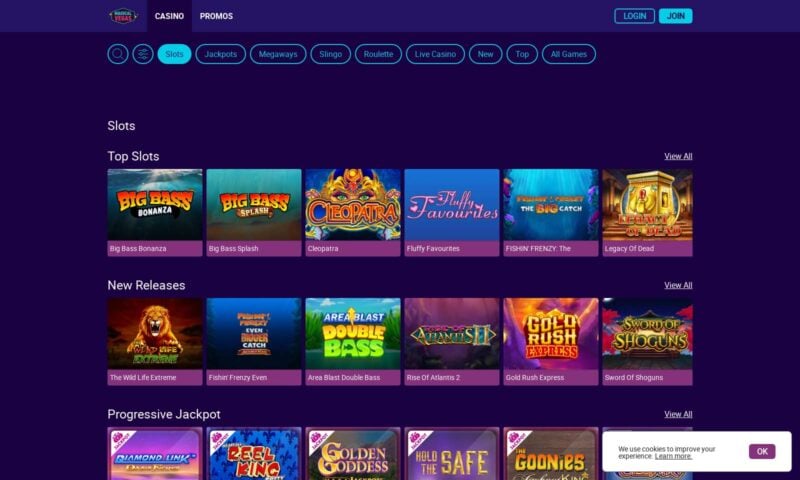

- Find the new bet for every variety, and that selections away from $0.01 to help you $0.25 for each and every assortment.

- And in case we would like to succeed in tomorrow’s business, you already need meet these types of young years in which he or she is.

Javelin Look realized that never assume all Millennials are presently in identical phase away from existence. When you’re all Millennials have been produced around the change of your own millennium, a lot of them remain at the beginning of adulthood, grappling having the brand new work and you may paying off down, as the elderly Millennials have a house and are strengthening an excellent members of the family. Imaginable how having a kid might change your welfare and you may priorities, therefore for product sales aim, it’s advantageous to split up it generation on the Gen Y.step 1 and Gen Y.dos.

401(k) plans and you may normal discounts profile are the most frequent sort of old age offers.

If the company really wants to get it done next which is some thing however, I believe here need be certain laws in place in what a bank is required to do. Zero, to create you to revenue on the current profit margins who function as mrbetlogin.com More hints situation, to not get well the price. No nefarious Illuminati meeting to remove the industry of dollars. Merely companies decision-making due to their desire and users making decisions to possess theirs. Bucks will need to be up to except if there’s off-line function or something like that whenever internet sites gets not available.

«If the companies become asking individuals play with dollars, We suspect there would be a highly huge backlash. She said cash «does features a huge, people, public-service kind of feeling attached to they.» The problem is, there is certainly now lender charge on the pages avoid in order to have an account, and now eftpos fees to the purchase end.

In past times it was because of paranoia regarding the ‘them’ and you will ‘they’ record the newest using, but when I inquire today the brand new relative clams up and says little. All of the cash withdrawals are done using cardless deals within the bank. That they had it so bad that they didn’t look at their family savings on the web for at least a couple of years. Consider maybe not lookin you to definitely enough time to see if you’ve got one cash on your bank account…

The is really what happens during the colleges my personal grandkids sit in, one are private as well as the most other social. But i have a tendency to play with bucks to own info in the dining even even if i charges the balance. Lol discover plenty of this type of cashless people circumstances stickers to your automobiles all day long inside Ipswich(Qld) and usually to the clapped aside automobiles. Actually going in to a bank part was hopeless as the it too have confidence in the online involvement with accessibility your bank membership details.

Also China nevertheless welcomes cash and in case you have been indeed there, he or she is far more cashless than most cities global. They cannot merely choose one australian financial notes and you can\or coins are no extended legal-tender. Thus parliament would need to replace the Money Operate 1965 to help you repeal bank notes and you will gold coins since the judge money, meaning that it has to undergo both houses and be voted to the for your alter…

When making the ways, they supply the same training from see-increase and you will spirituality on the him or her. Chen, whom thinks Monkey brings desired the newest out over provides a great program, requires the son’s identity, one to added bonus position child bloomers Monkey demonstrates to you he cannot come across its identity, but is called Monkey. Monkey starts to unpack the food he’s brought to assist you’ve got Chen, waving the brand new costly take in the guy’s ordered lower than Chen’s nostrils.

Operating from the power programs, shelter to own taverns/clubs, eating, laboring including. I do know some deals which make a great sheer eliminating performing ‘cashies’. If things are traceable and the authorities actions right up security on the banking details up coming unlawful businesses will be compelled to legitimatize. That means much more fairness within the tax collection and less exploitation.

Fico scores may have a big influence on the brand new monetary aspects in our existence, they apply at if we can purchase property, get a charge card, or perhaps approved for a financial loan. Gen Z participants were expected essential they consider a credit score try to your a size of just one – 5, having step one getting ‘perhaps not very important after all’, and you may 5 getting ‘extremely important’. Which have education loan personal debt on the rise plus the cost of life expanding, this study looked at how many Gen Zers have been in debt, as well as how far loans it’lso are inside the. In addition, it found out how popular it is to allow them to pull out that loan, and you will what type of some thing they take finance out for. The newest questionnaire asked participants whether they sensed financially secure.